Axpo in Austria Shaping a climate-friendly future

About Us

Axpo Austria has been active on the Austrian energy market since the year 2000 and offers structured electricity and gas procurement for industrial customers, balance group management for suppliers and the marketing of electricity from generation plants. Other services include long-term price hedging, the marketing of flexibilities and trading in CO₂ emission certificates and guarantees of origin. Networking within the Axpo Group gives us access to relevant market information and trading platforms in Europe. The team of Roman Stütz (Managing Director) looks forward to hearing from you.

Energy Solutions

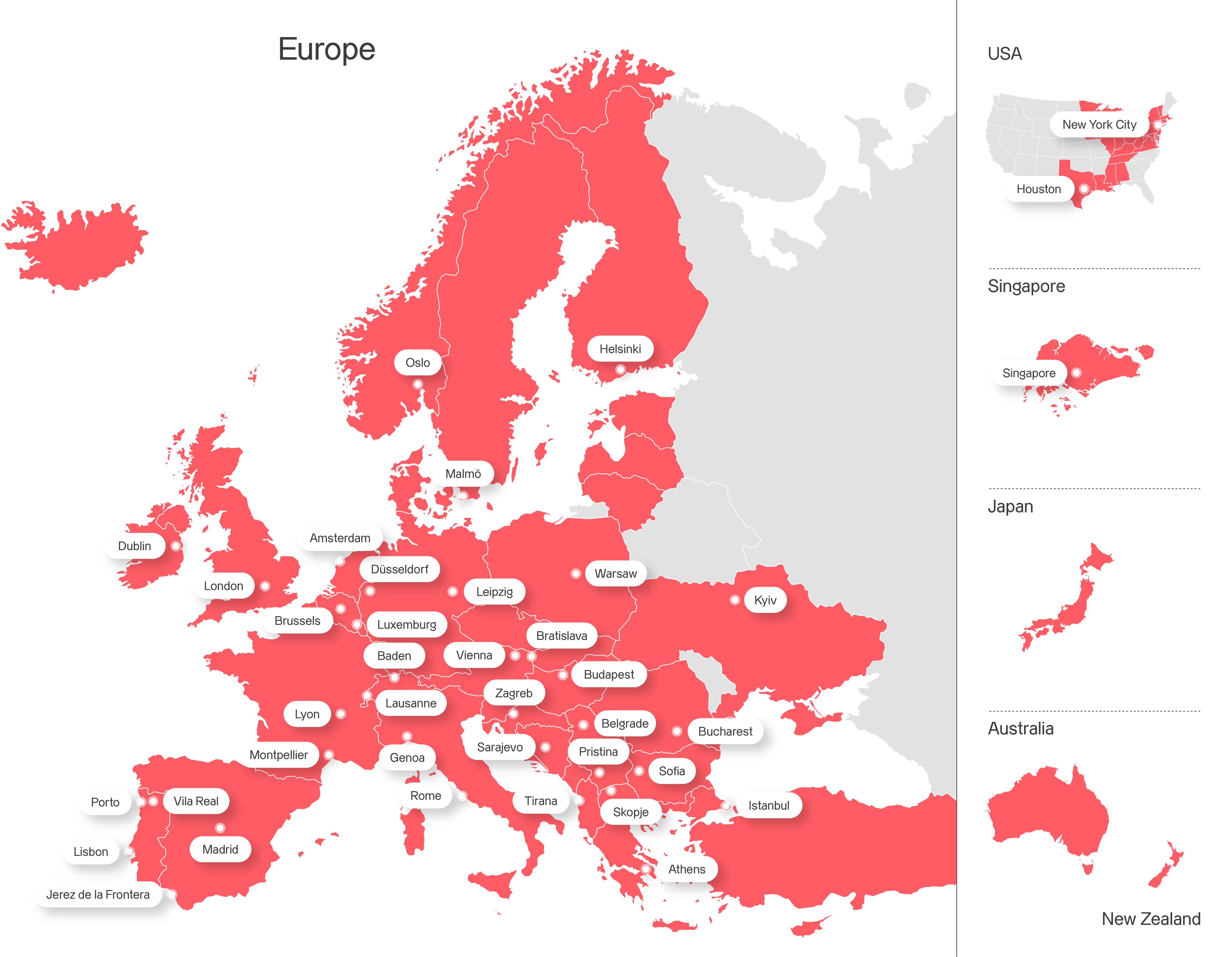

Axpo is driven by a single purpose – to enable a sustainable future by providing innovative energy solutions. Axpo is Switzerland's largest power producer and an international leader in energy trading and the marketing of solar and wind power. Axpo combines the experience and expertise of more than 7,000 employees who are driven by a passion for innovation, collaboration and impactful change. Using cutting-edge technologies, Axpo innovates to meet the evolving needs of its customers in over 30 countries across Europe, North America and Asia.

Powering the future with global expertise and innovation

Employees

Years of experience

Countries

Get in touch with us

We appreciate your interest in Axpo and are here to help. Please complete the contact form and our team will respond promptly to your inquiry.

Jobs & Careers

-

Diverse career opportunities

Axpo offers more than 150 different employment profiles, providing a wide range of career paths for professionals, students, graduates, and apprentices.

-

Commitment to sustainability

Axpo employees contribute to building a sustainable future through innovative and climate-friendly energy solutions.

-

Focus on innovation

Axpo prioritises the rapid testing and validation of innovative projects, fostering a culture of progress and collaboration in the global energy sector.