Axpo in Czechia Shaping a climate-friendly future

About Us

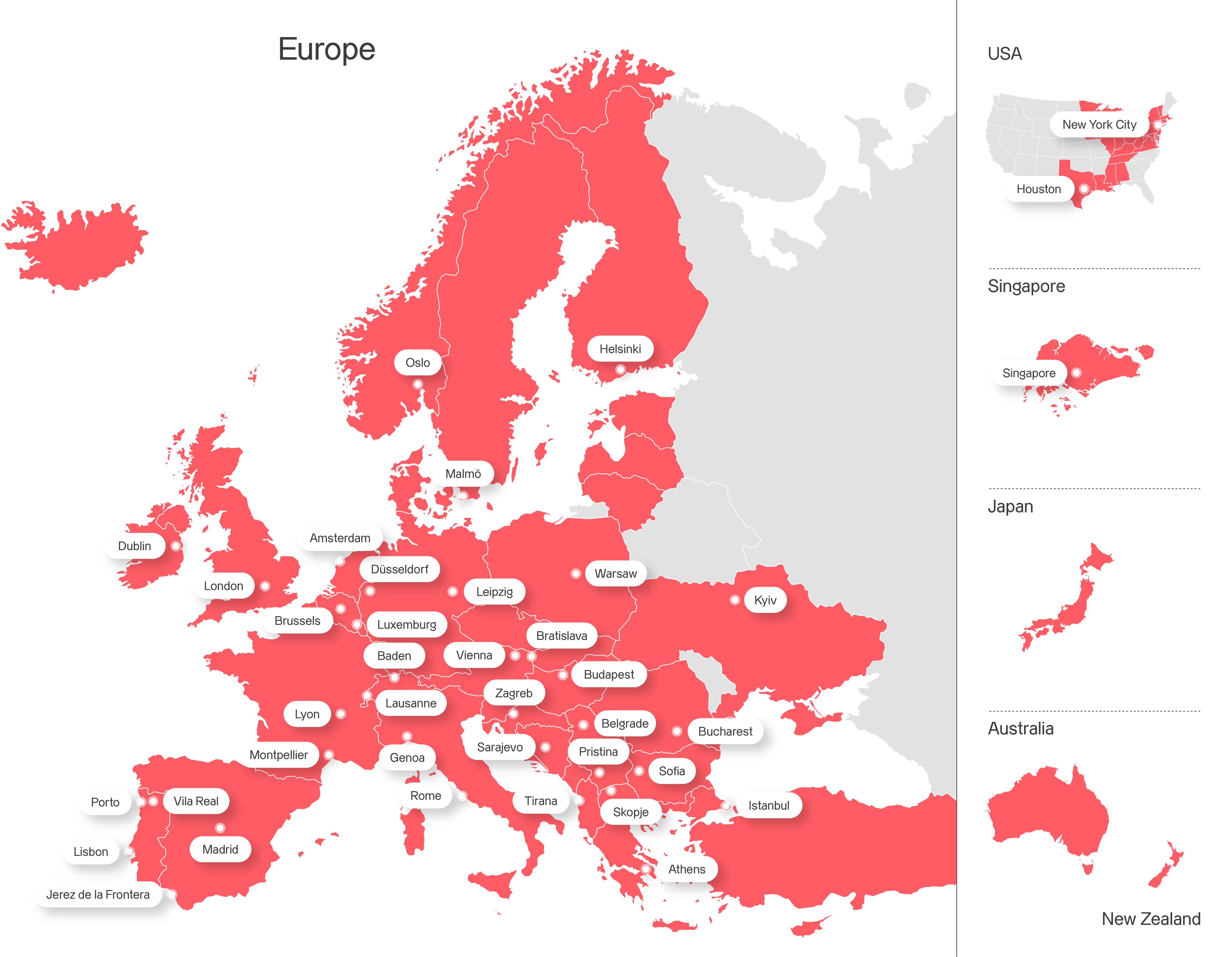

Axpo is driven by a single purpose – to enable a sustainable future by providing innovative energy solutions. Axpo is Switzerland's largest power producer and an international leader in energy trading and the marketing of solar and wind power. Axpo combines the experience and expertise of more than 7,000 employees who are driven by a passion for innovation, collaboration and impactful change. Using cutting-edge technologies, Axpo innovates to meet the evolving needs of its customers in over 30 countries across Europe, North America and Asia.

Powering the future with global expertise and innovation

Employees

Years of experience

Countries

Energy Solutions

Axpo provides innovative energy solutions tailored to your needs, combining expertise in optimization, risk management, and market analysis. Our diverse portfolio includes renewable energy, portfolio management, and efficiency solutions, helping businesses reduce costs, manage risks, and secure a sustainable energy future.

Jobs & Careers

-

Diverse career opportunities

Axpo offers more than 150 different employment profiles, providing a wide range of career paths for professionals, students, graduates, and apprentices.

-

Commitment to sustainability

Axpo employees contribute to building a sustainable future through innovative and climate-friendly energy solutions.

-

Focus on innovation

Axpo prioritises the rapid testing and validation of innovative projects, fostering a culture of progress and collaboration in the global energy sector.

Laws & Regulations

Stay informed about the legal frameworks and policies that shape our operations. Visit our Laws and Regulations page to learn more about the standards we adhere to and our commitment to compliance and transparency.