Axpo Albania | Kosovo Shaping a climate-friendly future

About Us

Axpo Albania sh.a has been a key player in the country’s energy sector since 2005. Focused on power trading, the company collaborates with numerous partners in the Albanian energy market, including state-owned KESH, its largest power producer. Axpo Albania sh.a is a member of the Albanian Power Exchange (ALPEX) and is committed to actively participating in the day-ahead market on an ongoing basis. Our Managing Director Kenan Karamehmedovic and Country Manager Evis Puka would be glad to hear about your energy needs.

Powering the future with global expertise and innovation

Employees

Years of experience

Countries

Energy Solutions

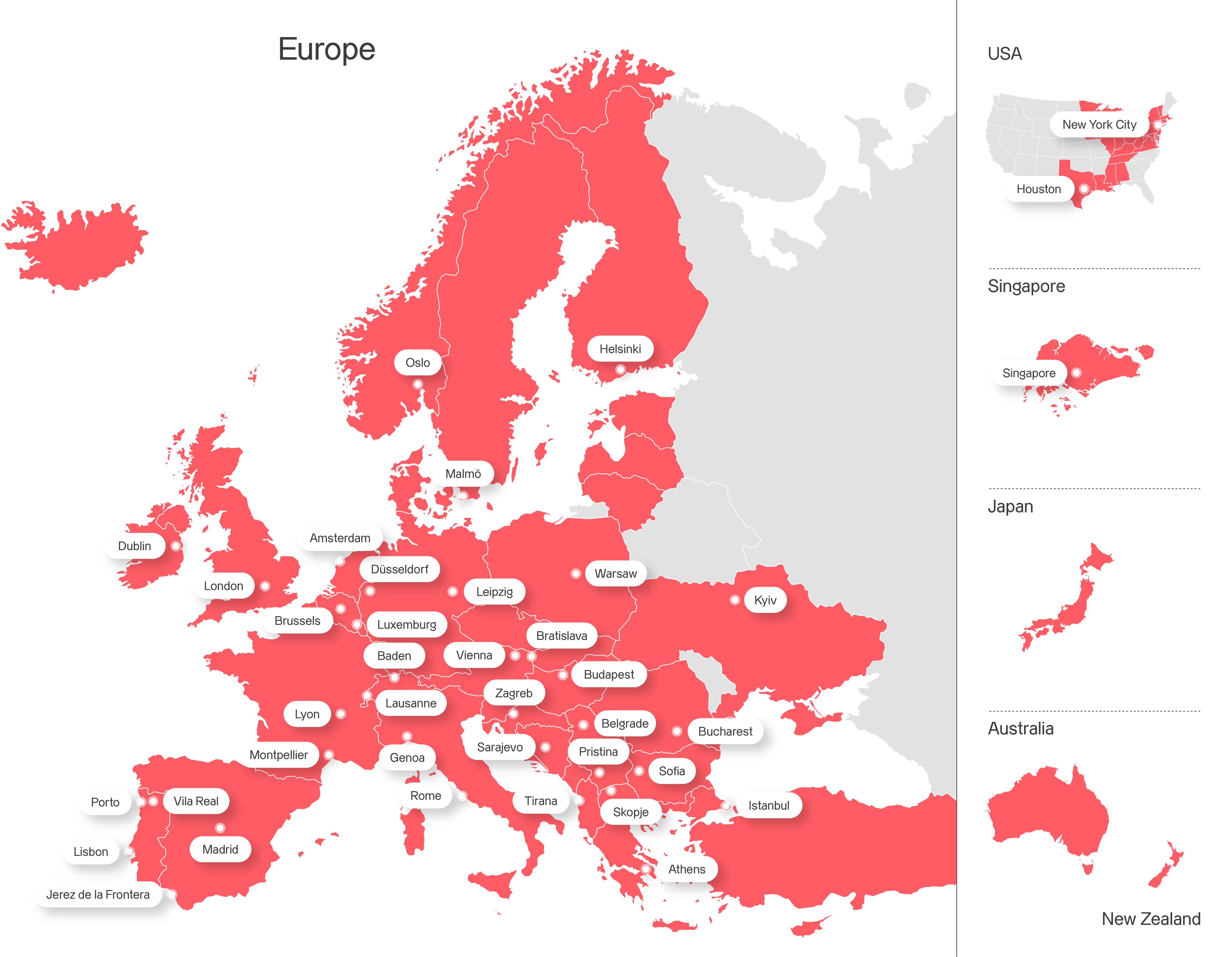

Axpo is driven by a single purpose – to enable a sustainable future by providing innovative energy solutions. Axpo is Switzerland's largest power producer and an international leader in energy trading and the marketing of solar and wind power. Axpo combines the experience and expertise of more than 7,000 employees who are driven by a passion for innovation, collaboration and impactful change. Using cutting-edge technologies, Axpo innovates to meet the evolving needs of its customers in over 30 countries across Europe, North America and Asia.

Get in touch with us

We appreciate your interest in Axpo and are here to help. Please complete the contact form and our team will respond promptly to your inquiry.

Jobs & Careers

-

Diverse career opportunities

Axpo offers more than 150 different employment profiles, providing a wide range of career paths for professionals, students, graduates, and apprentices.

-

Commitment to sustainability

Axpo employees contribute to building a sustainable future through innovative and climate-friendly energy solutions.

-

Focus on innovation

Axpo prioritises the rapid testing and validation of innovative projects, fostering a culture of progress and collaboration in the global energy sector.