Axpo Bulgaria Shaping a climate-friendly future

About Us

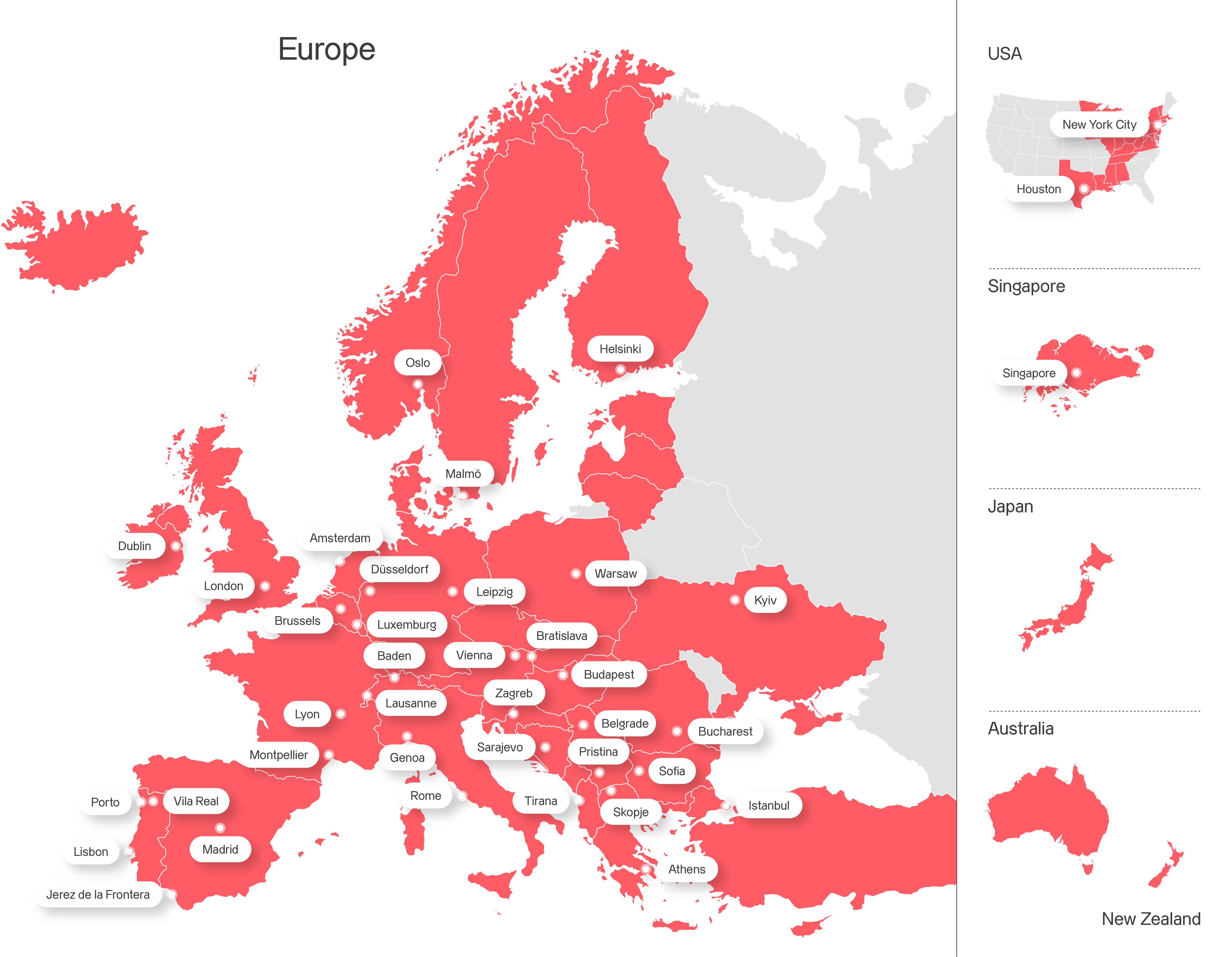

Established in 2006, Axpo Bulgaria is part of the Axpo Group, Switzerland’s leading producer of renewable energy and a major participant in international energy trading. We are a regional trading hub for gas and power, operating in 15 energy markets across Central and Eastern Europe.

Our origination business establishes and maintains partnerships with key customers throughout Bulgaria. Thanks to the outstanding performance of our teams, today Axpo Bulgaria is the Operations Centre of Excellence for Axpo Solutions AG. More than 115 employees in Sofia are responsible for providing a wide range of highly specialised and complex energy operations and back-office services to the Axpo Group. Milena Videnova's team would be happy to hear from you.

Since 2020 - a trading hub for Axpo T&S in Central and Eastern Europe

Markets

in Central and Eastern Europe

Licenses

for power and natural gas

Employees

working full-time

Energy Solutions

Axpo is driven by a single purpose – to enable a sustainable future by providing innovative energy solutions. Axpo is Switzerland's largest power producer and an international leader in energy trading and the marketing of solar and wind power. Axpo combines the experience and expertise of more than 7,000 employees who are driven by a passion for innovation, collaboration and impactful change. Using cutting-edge technologies, Axpo innovates to meet the evolving needs of its customers in over 30 countries across Europe, North America and Asia.

Get in touch with us

We appreciate your interest in Axpo and are here to help. Please complete the contact form and our team will respond promptly to your inquiry.

Jobs & Careers

-

Diverse career opportunities

Axpo offers more than 150 different employment profiles, providing a wide range of career paths for professionals, students, graduates, and apprentices.

-

Commitment to sustainability

Axpo employees contribute to building a sustainable future through innovative and climate-friendly energy solutions.

-

Focus on innovation

Axpo prioritises the rapid testing and validation of innovative projects, fostering a culture of progress and collaboration in the global energy sector.

Laws & Regulations

Stay informed about the legal frameworks and policies that shape our business operations. Visit our Laws and Regulations page to learn more about the standards we adhere to and our commitment to compliance and transparency.