Axpo in the US Shaping a climate-friendly future

About Us

Axpo is focused on delivering energy supply and risk management solutions to consumers, producers, and retailers of electricity and natural gas. Our contracts are designed specifically to meet the unique demands of our customers.

We are part of the Axpo Group, Switzerland’s largest energy producer and an international leader in energy trading and the marketing of wind and solar power.

Powering the future with global expertise and innovation

Employees

Years of experience

Countries

Energy Solutions

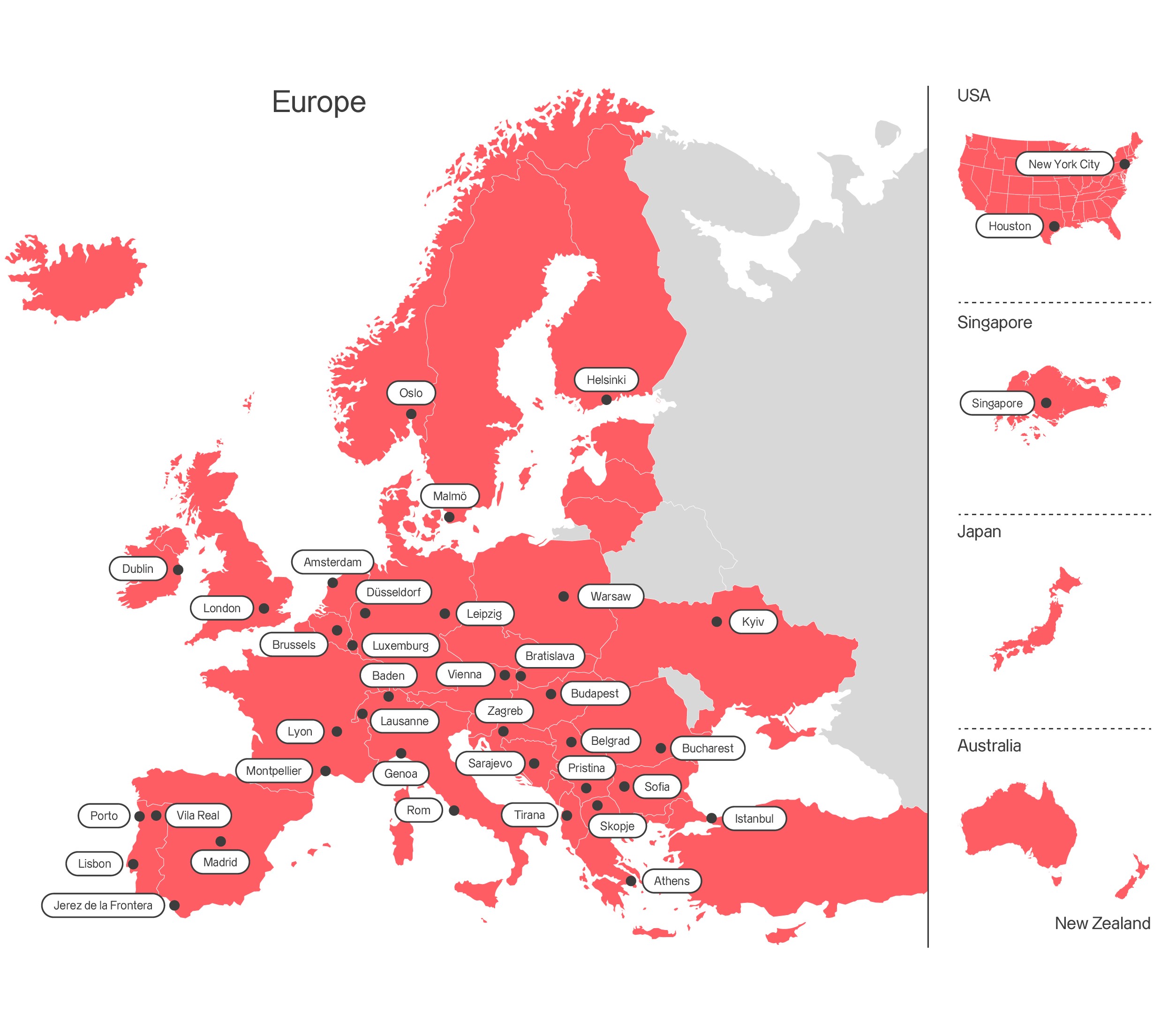

Axpo is driven by a single purpose – to enable a sustainable future by providing innovative energy solutions. Axpo is Switzerland's largest power producer and an international leader in energy trading and the marketing of solar and wind power. Axpo combines the experience and expertise of more than 7,000 employees who are driven by a passion for innovation, collaboration and impactful change. Using cutting-edge technologies, Axpo innovates to meet the evolving needs of its customers in over 30 countries across Europe, North America and Asia.

Renewable energies

Axpo offers a comprehensive range of renewable energy solutions, including green electricity and natural gas sourced from diverse renewable technologies such as wind, solar, biomass, hydropower, and renewable natural gas. With a strong portfolio across the United States, Axpo provides tailored regional and individual energy solutions to energy suppliers. Our services include the provision of certificates of origin and quality labels, as well as the direct marketing of renewable energies, ensuring additional revenue, long-term investment security, and freedom from administrative and operational costs.

Full market access

Axpo provides access to all major power exchanges, enabling trading across various maturity periods with structured options, standard products, and OTC transactions. With a strong presence in European and US markets and expertise in risk management, we offer customers the flexibility to fix and unfix prices up to 15 years in advance.

Risk management solutions

Our offerings include bespoke credit solutions tailored for independent retailers, prepayment options for independent electricity and gas producers, and structured purchase and sale agreements for electricity, natural gas, and associated renewable energy certificates. These solutions enable counterparties to achieve their desired risk profiles through features such as indexations, embedded caps and floors, and flexible financing options.

Bespoke PPAs

Our solutions are available for all renewable energy technologies and businesses seeking corporate Power Purchase Agreements (PPAs). They are bankable and approved by all tax equity providers and lenders, offering reliability and financial security. Tailored to meet both short- and long-term needs of up to 15 years, these solutions can also incorporate non-standard risk management instruments, such as price floors and indexations, to provide flexibility and added value.

Non-standard risk management

Our customers can benefit from a variety of non-standard risk management instruments such as price shapes, caps and floor products, and other energy flexibility monetization solutions.

Jobs & Careers

At Axpo, our people set us apart. The company offers an attractive benefits program that is competitive with top companies in the industry. In addition, we are committed to supporting the health and well-being of our employees - and strive to create an inclusive, flexible workplace culture that encourages innovative ways of working.

-

Comprehensive medical and dental insurance

-

401(k) Retirement Savings, with Company match

-

Paid time off and family leave

-

Flexible Spending Account (FSA)

-

Health benefits, disability, and life insurance

-

Pre-tax commuter benefits

Get in touch with us

We appreciate your interest in Axpo and are here to help. Please complete the contact form and our team will respond promptly to your inquiry.