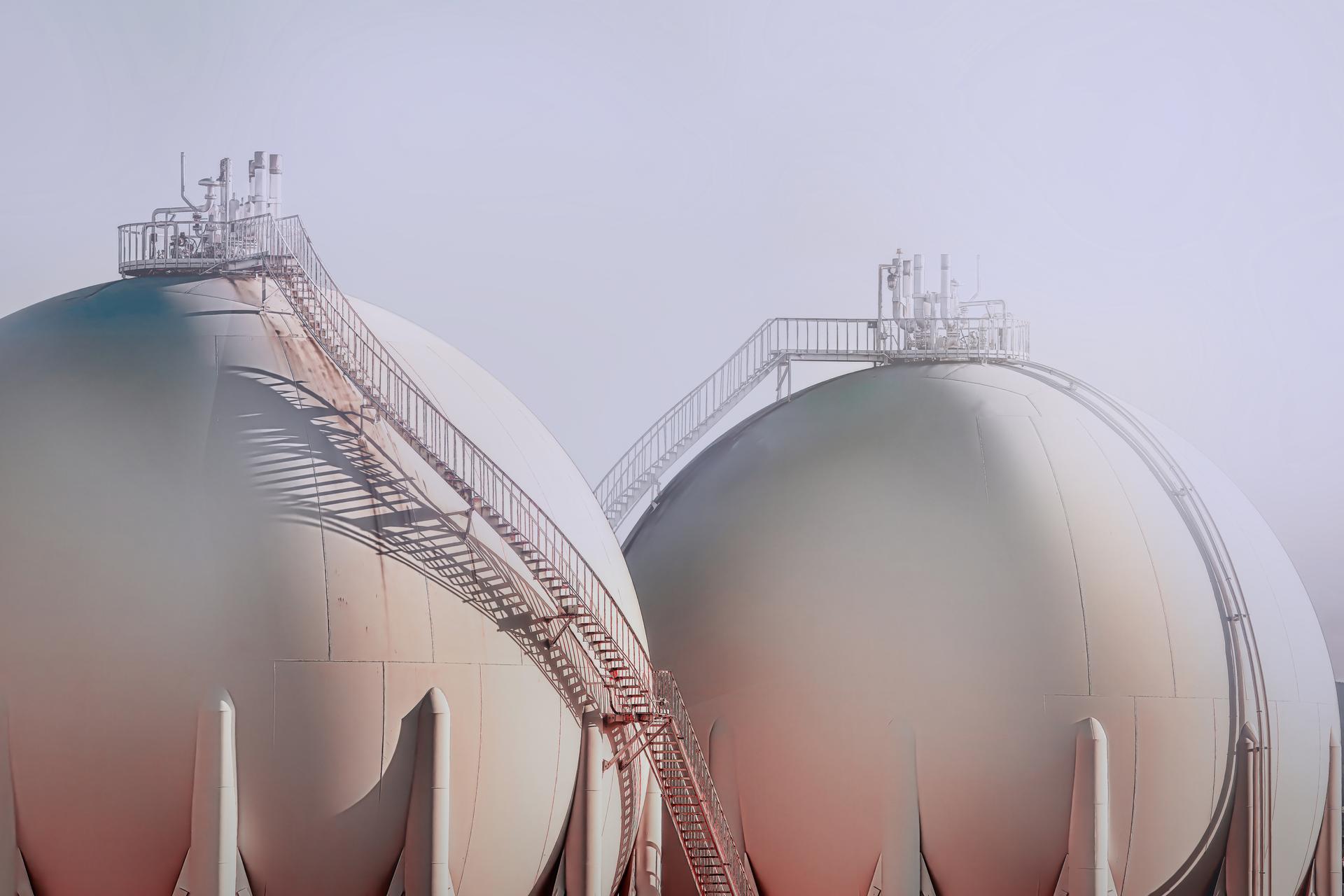

Fuels Fuels derivatives solutions

Axpo offers a wide range of financial products to several different client segments. In order to do so, we have an extensive toolbox to work with. On the underlying products, we have a full OTC trading mandate for the whole barrel. That means everything from heavy fuel oil and diesel to petrochemicals. The instruments we offer are the standard futures and swaps but also the corresponding option structures. We are flexible on both volumes and tenors.

We like to use our in-depth knowledge of the markets and flexible mandates to help our clients manage their oil risks in the best way possible. For investors we can offer market access to all OTC oil products as well as listed contracts. This can be facilitated without margining, which preserves cash and makes it easy to open or close positions.

We trade oil at competitive terms and have full market access.

Please get in touch with us if you want to know more about hedging or investing in the oil market.